Tax tips to help you avoid scams and stand up to the IRS

Did you know as a taxpayer that you are protected under a Taxpayer Bill of Rights?

You can read more about the Taxpayer Bill of Rights on the IRS website, but I wanted to make certain you are aware of your rights. By being familiar with these “rights,” you will easily identify scammers as well.

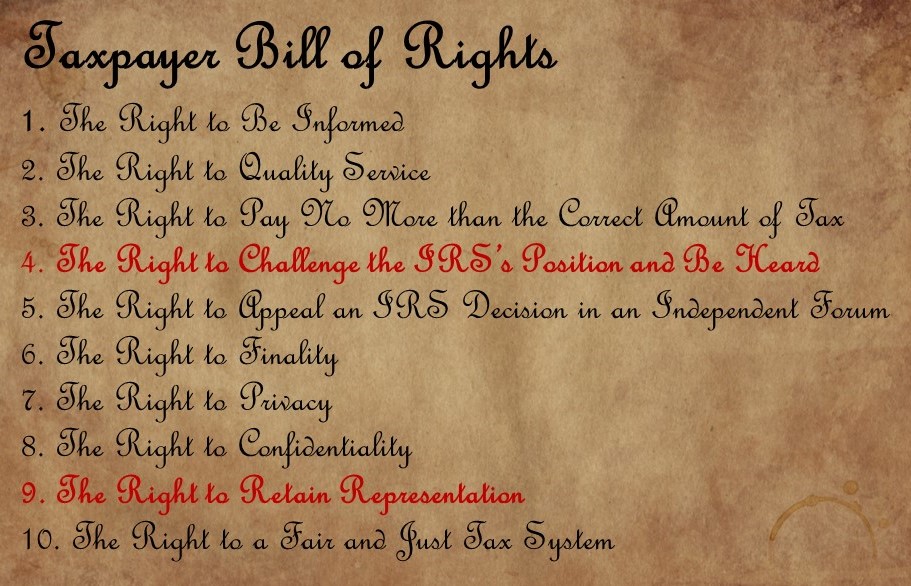

Here’s an overview of your 10 Taxpayer Bill of Rights:

1. The right to be informed. You have the right to know what is required to comply with the tax laws.

2. The right to quality service. You are to receive prompt, courteous and professional assistance.

3. The right to pay no more than the correct amount of tax.

4. The right to challenge the IRS’s position and be heard. More details below.

5. The right to a fair and impartial appeal to an IRS decision in an independent forum.

6. The right to finality.

7. The right to privacy.

8. The right to confidentiality.

9. The right to retain representation before the IRS on your behalf. More details below.

10. The right to a fair and just tax system.

The IRS tries to administer fair and just processes while trying to identify those who are trying to cheat the system. For the tax code to be fair, all citizens must fall under the same rules and regulations.

However, most people are not aware of their rights. Plus, many scammers out there try to convince you that you don’t have any! That’s why we want to help the IRS get the word out about these privileges and go into some detail on two, important ones.

First, you have the right to challenge an IRS position and be heard.

Have you ever received a letter from the IRS that said you owed money or made an error and know that you didn’t? Well, before you yell obscenities and throw the notice in the garbage, you have rights!

Specifically, the IRS reports their changes to you based on the information they have been provided by other entities. Sometimes, these entities do not file correct forms with the IRS. So, if you have an issue with the IRS, there is no need to feel defensive.

Just gather the letter you received from the IRS, and/or other correspondence so you, or your tax preparer, can view the information and make the appropriate adjustments. Often times, the IRS is correct… but not always! That is why you have a right to challenge a decision and provide additional documentation to support your position or objection.

What if you disagree with an IRS decision?

The key is to respond promptly. If you receive correspondence from the IRS you do not agree with, they usually provide the timeframe you have to respond. You have the option to call or mail in your information. For example, let’s say the IRS notifies you of a simple mathematical or clerical error, and you disagree with any adjustments the IRS made to your tax return. You have 60 days to respond to their letter and provide copies of your records to help correct the errors.

If the IRS agrees with the documentation you submitted, they will send a correction. If not, they will send you a written notice in the mail proposing the tax adjustment they recommend. But they will also outline how to challenge their decision if you disagree with it.

If you still disagree, you have the right to be heard before The Independent Appeals Office. As an independent organization within the IRS, they will try to work out a settlement with you via an informal, fair administrative process.

If you still believe you are being taxed or treated unfairly after exhausting your administrative options, you may file a petition to the U.S. Tax Court. This is a federal court established by the U.S. Congress that, “is committed to providing taxpayers, most of whom are self-represented, with a reasonable opportunity to appear before the Court, with as little inconvenience and expense as is practicable. The Court is also committed to providing an accessible judicial forum with simplified procedures for disputes involving relatively small amounts of tax.”

Note that it is important for you, the taxpayer, to respond within the timeframe stated in the letter. For appeals, this is typically 90 days from the date of the notice. (If the taxpayer is living outside the U.S., they have and an additional 60 days to respond.)

Does this seem a bit intimidating?

Well, the second Taxpayer Bill of Rights I want to point out is that you don’t have to do this alone!

You do not need to self-represent yourself before the IRS, Appeals Office or U.S. Tax Court. Instead, you can retain and authorize a qualified representative to help you deal with the IRS. This includes attorneys, CPAs, enrolled Agents, enrolled actuaries, or other persons permitted to represent taxpayers before the IRS. It you hire a representative, you will not have to appear unless formally summoned by the IRS.

There is even an independent, Low Income Taxpayer Clinic available to taxpayers whose income is below a certain level and can represent individuals in audits, appeals or tax collection. To learn more, go to https://www.irs.gov/advocate/low-income-taxpayer-clinics. This service is one of the Taxpayer Advocate Services programs.

You have rights!

The next time you get correspondence from the IRS that has errors you want to correct, remember your Taxpayer Bills of Rights! There are procedures, independent organizations and tax professionals available to help you review mistakes with the IRS and correct the information without massive legal fees and stress. And the best part is that you don’t have to do it alone!

Connection Secure: Your information is private when it is sent to this site.

Connection Secure: Your information is private when it is sent to this site.