K.E.E.P More of The Money You Earn!

Finally, simple tax preparation services designed for people like you who work hard…

Let’s face it. You have better things to do than read over 70,000 pages of the U.S. tax code and try to understand it. In fact, you’d probably rather do just about anything else.

This is where we come in with our tax preparation services.

Unlike most, we regularly review the tax codes and the latest updates to see how this data can help our clients.

This allows you to sit back and relax knowing that your tedious, tax preparation is being completed the right way… without wasting time or money.

But even more important, our proprietary K.E.E.P. tax system helps you:

- Keep more of what you earn.

- Ensure you pay minimal taxes.

- Embrace future, attractive tax opportunities.

- Proactively enhance your retirement lifestyle.

With K.E.E.P., experienced, certified tax preparers relieve your current tax headaches AND look at your data from an overall, long-term perspective.

After all, if you don’t look at your entire financial situation, you may face major tax implications in retirement… when you can least afford it!

For example, many tax preparers don’t understand the impact that Required Minimum Distributions (RMDs) will have on your retirement. These distributions are taxable and can make up to 85% of your social security benefits taxable.

So, if your tax preparer doesn’t know what they’re doing, they can inadvertently put you in a higher tax bracket in retirement where you get hit with larger taxes later in life.

Worst of all, if your spouse passes away and you’re unprepared, it can have a devastating impact on the surviving spouse’s financial future!

Believe it or not…

If you are a good saver, the wrong tax preparer can bump you into a higher tax rate in retirement (when you can least afford it) due to higher RMDs!

You owe it to yourselves to know where you stand with your taxes today!

Now, there are different ways to get around these tax consequences if you are aware of the opportunities and are willing to act on them.

Obviously, there is no one strategy for all people or businesses, and your situation will be as unique as you are.

The right strategy is the one you are most comfortable with implementing after knowing all the facts.

Ready to find out more?

Call us today at (920) 944-6020 or (678) 491-9744 for your FREE initial tax and financial evaluation to discover how you can:

- Leverage your resources efficiently with clear, action steps;

- Improve the relationship between your goals, investments and other resources for more success;

- Incorporate tax minimization strategies;

- Assess your risk exposure; and

- Control your financial situation in the future!

There is no risk or obligation to get your initial personalized plan. And rest assured, your information remains private and protected.

We look forward to helping you save time, money and stress now and in the years to come!

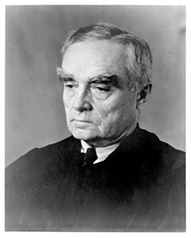

From 1909-1951, Judge Learned Hand served as a federal judge and is widely quoted for his profound thoughtfulness. Regarding taxes he wrote:

“Over and over again courts have said that there is nothing sinister in so arranging one’s affairs as to keep taxes as low as possible. Everybody does so, rich or poor; and all do right, for nobody owes any public duty to pay more than the law demands: taxes are enforced exactions, not voluntary contributions. To demand more in the name of morals is mere cant.”

In his dissent in the Commissioner of Internal Revenue v. Newman case

To these principals we hold dear! Your tax preparer will strive to minimize your tax obligations in a legal and ethical manner and will not promote unethical tax avoidance strategies. (If that’s your “gig,” we are not a good fit for you!)

To learn more about our tax preparation services, contact us directly here.

Connection Secure: Your information is private when it is sent to this site.

Connection Secure: Your information is private when it is sent to this site.